What are Smart Contracts?

When we try to assess smart contracts we first need to understand what this term means.

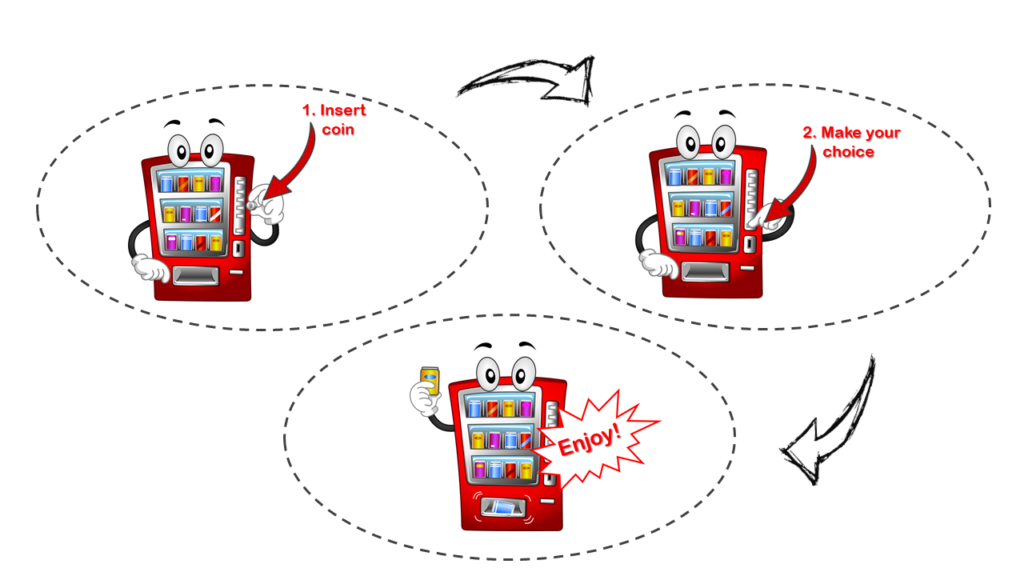

It is generally agreed that Nick Szabo was the first to use this term. The gist of his definition is that smart contracts are contractual clauses embedded in hardware and software in such a way that a breach of contract is – prohibitively – expensive. He refers to vending machines as a first historic example of smart contracts. More details can be found in his paper Formalizing and Securing Relationships on Public Networks published back in 1997.

Smart contracts don’t work without the human element

While this definition might not exactly work for legal purposes, it is still a good starting point. Applications that are legally valid will need some sort of human interaction. For example, the parties have to express their intention to execute a smart contract and the transaction must meet additional requirements. But we shall come to that later.

Although today smart contracts are usually referred to in the context of a blockchain, there is no need to have a blockchain to implement them. A blockchain is just one possible way of implementation and we will show different examples which should be self-explanatory (or so we hope).

- A very simple ‘archaic’ form

- Comparison of analogous transaction to smart transaction

- Smart contract on the blockchain

1. The vending machine – predessessor of modern smart contracts

The vending machine, simple as it seems, is one of the first examples of a smart contract. The owner of the machine offers to sell a product. You insert a coin, press a button to make your choice and thereby accept the offer. The machine dispenses the product and the purchase is perfected. In other words, you enter into an agreement with the machine’s owner. All the terms are embedded in the machine’s code and you start the routine when you press the button.

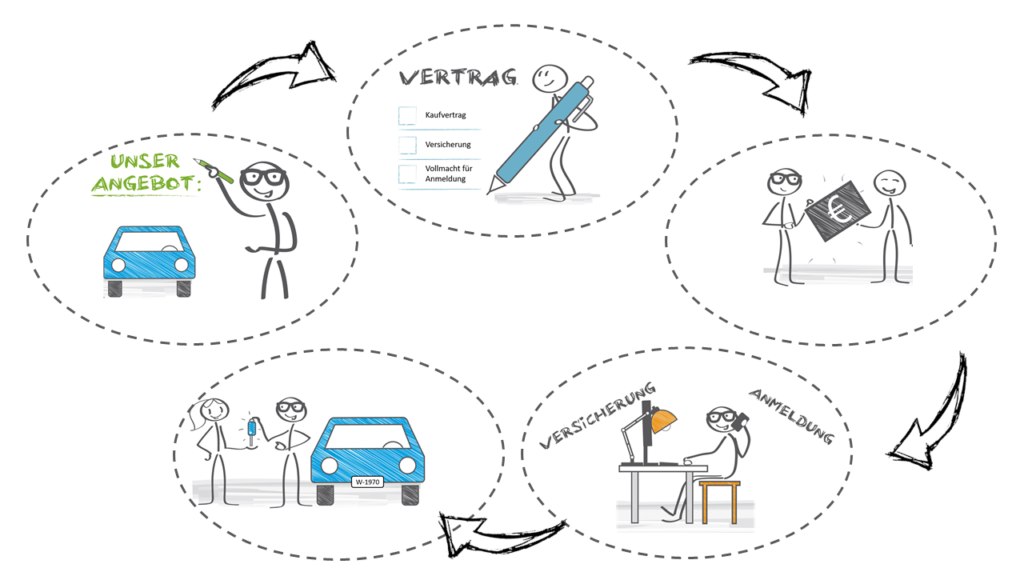

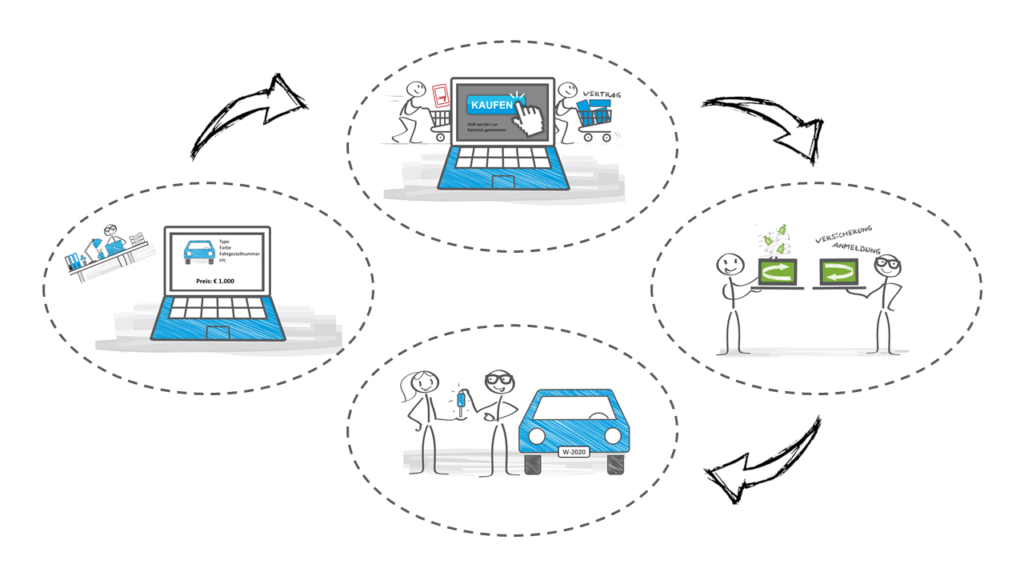

2. Buying a car – in a traditional way or ‚smart‘

Most of us have bought a car at some point in their life. Again, usually a very straightforward procedure. We hassle a bit about the price with the car dealer. Then we tend to sign a boilerplate agreement and pay the purchase price. The dealer takes care of insurance and registration of the car. He installs the licence plate, then gives us a call and we go back to the shop. The dealer hands over the keys and the papers and the purchase is perfected. In the end, we get in the car and drive away

When we try to move the above ‘analogue’ transaction to a digital environment, it becomes obvious that what seemed simple at first is more complicated than we thought. We need significant data input and quite a number of automated ‘transactions’ take place before we get a satisfactory result. And more importantly, we still need need people for some of the steps; for example, to digitally sign the acceptance of the offer or to hand over and take over the car.

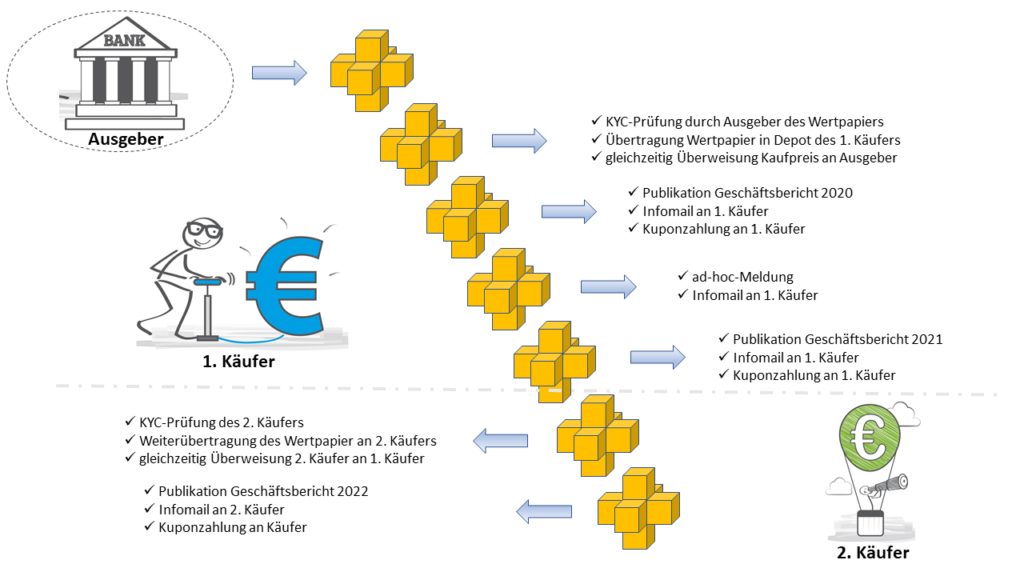

3. Trading securities on the blockchain

As mentioned, a blockchain is only one of many possible technologies to implement smart contracts. At the current stage of development, it would probably not make sense to use this technology for a car purchase. But it could be useful in the world of stock and securities trading – as long as you use a private blockchain. But make no mistake: it might sound perfect in theory, but practice raises quite a few questions to consider.

This is our first entry in this blog about smart contract design. There are many more to follow, so stay with us and sign up to our alerts.